Building Systems, Communities, and the Future of Scale

The Growpreneur Accelerator proudly introduces its 4th cohort of startups, a bold and diverse group of founders developing scalable solutions across infrastructure, AI, agriculture, digital commerce, parenting, sustainability, and community platforms.

Following an intensive two-day BoostCamp, where startups refined their ideas, sharpened their value propositions, and defined clear next steps, the cohort now moves into the core acceleration phase with focus and momentum.

This year’s batch stands out for one reason: these founders are not just launching products, they are building structured systems designed for growth.

Digital Infrastructure & Smart Platforms

Pitstop

Pitstop is building a network of 24/7 automated self-service laundry and RV kiosks at fuel stations. With secured locations and a clear rollout strategy, the company is laying down physical infrastructure designed for regional scale. It’s not just a service, it’s a standardized utility model built for expansion.

Katalogim

Katalogim is modernizing the construction industry through an AI-powered marketplace. By enabling smart material search, supplier comparison, and digital project management, it brings efficiency to a traditionally offline sector. It represents a digital leap for one of the region’s largest industries.

Riparo

Riparo is bringing transparency to home services through fixed pricing and verified professionals. By structuring an informal market into a reliable digital platform, it creates trust and simplicity for households across Albania.

GM360

GM360 operates a global virtual tour production network powered by local city partners. By combining centralized quality control with local execution, it creates consistency at scale, something the fragmented virtual tour market has long lacked.

Community & Human-Centered Platforms

Kuturu

Kuturu is redefining long-term remote work by building structured community experiences for digital nomads. It integrates accommodation, workspace access, and curated local activities into one ecosystem, turning isolation into connection.

SparkYouth

SparkYouth blends AI matching with curated real-world events to help Gen Z build meaningful connections and verified soft skills. It bridges online interaction with real-life growth, addressing youth loneliness and employability at the same time.

NineHana

NineHana is creating a moderated digital space for pregnant women and new mothers. By combining verified expert access with community support, it offers clarity and emotional reassurance in an often overwhelming life stage.

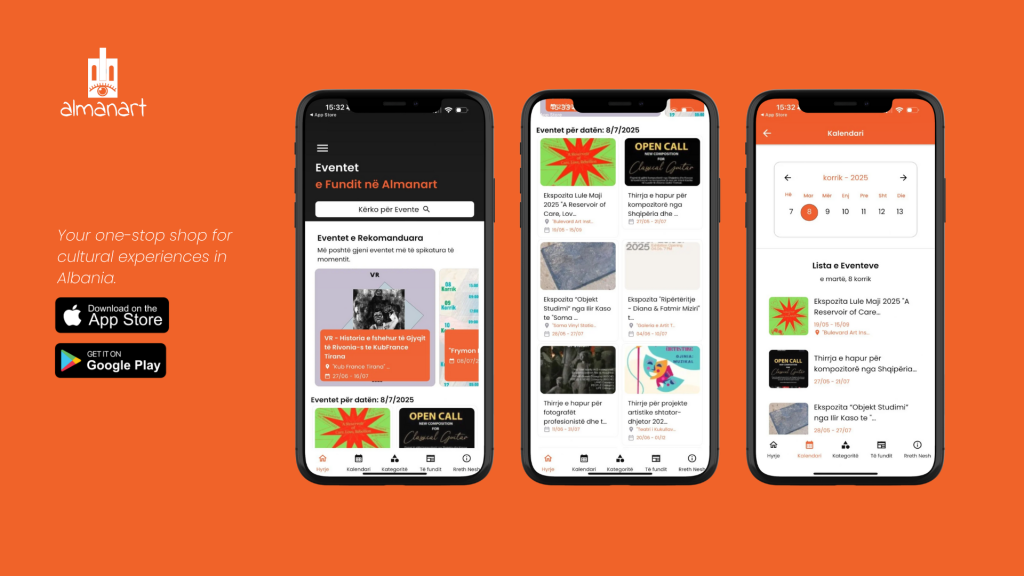

Today In Tirana

Today in Tirana centralizes the city’s events into one structured platform. It enhances discoverability for users while giving organizers better visibility and tools, strengthening the city’s cultural ecosystem.

Applied AI & Smart Technology

SpeakGrow

SpeakGrow uses AI to support speech development in children, including those with special needs. By offering structured exercises and personalized feedback, it improves accessibility to consistent speech practice.

MEKO

Meko transforms vehicle diagnostics by interpreting car data and visualizing issues on a 3D model. Instead of confusing error codes, it provides clarity, making car repair more transparent and understandable

Kidoor

Kidoor is a digital parenting assistant that helps families manage learning, play, and everyday organization. By combining personalized guidance with curated services, it centralizes fragmented family needs into one smart solution.

Sustainability & Responsible Growth

99Brown

99Brown is a certified sustainable fashion brand producing eco-conscious clothing from biodegradable materials. It demonstrates that ethical production and contemporary design can grow side by side.

Doll’App

Doll’App structures the second-hand fashion market into one secure resale platform. By acting as a trusted intermediary, it supports circular consumption while simplifying transactions.

AgroBee

AgroBee builds a unified digital infrastructure for farmers, combining marketplace access, grant guidance, financing connections, and training tools. It empowers agricultural producers through integration, not fragmentation.

Ecosystem Thinking at Scale

AdreToday

AdreToday integrates commerce, travel, logistics, and promotion into a single digital ecosystem. Instead of competing as a single-feature app, it consolidates multiple services into one unified platform, designed for scale from the start.

From BoostCamp to Acceleration

The 4th Cohort officially began its journey at BoostCamp, where founders pressure-tested their assumptions and defined their most critical growth priorities. What emerged is a cohort entering acceleration with clarity, ambition, and structure.

These 15 startups reflect a maturing ecosystem, one that is moving beyond experimentation and toward scalable execution. They are building platforms, systems, and long-term value.

Stay with us as the 4th Cohort moves forward, from validation to traction, and from traction to growth.